In 2002, Mayor Anthony Williams introduced the "Home Again" initiative, a program designed to transform vacant and abandoned residential properties into single-family homeownership opportunities for residents. About a year ago, it died, and no one even noticed.

The program "bundled" groups of vacant houses and lots. It placed the bundles up for purchase by developers meeting certain qualifications. Developers were required to set aside a certain number of the houses in the bundle for affordable home ownership opportunities, while it would set the remainder at market rate. Keep in mind, these are not large city-owned properties like school or office buildings, but private homes that fell into government hands usually because of a calamity, such as a fire or collapse, or because it was abandoned.

While the program had some initial

successes, I came to notice that many of these properties, sat and sat some more. Given the emphasis placed to addressing privately owned vacant properties through the vacant property tax and increased enforcement, it seemed wrong that city-owned properties were left to rot.

A Mount Vernon Square house in the program (460 Ridge Street NW)

collapsed in November 2007 and the lot was then

neglected. Nearby, another property in the program, a historic facade, remained in that state for years while nearly every other house on the block was renovated and sold (454 N Street NW).

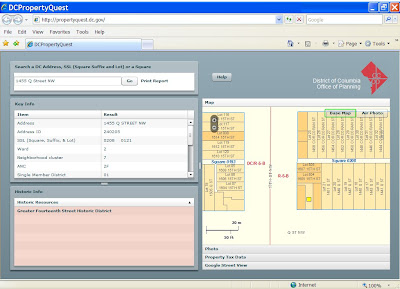

Last summer, I decided to investigate. I found that the District's

Home Again website had not been updated since April 2004. It remains in that state today. I also tried to find out the status of the properties in the Home Again program the old fashioned way -- calling. The phone number listed for the program immediately went a voice mail that appeared to be a wrong number. There was no e-mail contact information listed on the website.

Finally, I found a number for Home Again on a 2006 press release that led to the Department of Housing and Community Development's "Property Aquisition Disposition Division." On the third try, I reached someone. "There really isn’t a Home Again program," she said. Responsibility for the program now is through the Aquisition Disposition Division, which is now auctioning off the properties.

That brings us today. One year since my initial inquiry I toured Home Again properties. Through

DC Atlas, I found 113 properties identified by the city as in the program. One in four are vacant homes ("vacant improvement") and the remainder are empty lots. They are in every area of the city except Ward 3. The most, 47, are concentrated in Ward 5. I began by visiting properties in Wards 1 and 2.

I expected the worst. Overall, however, the properties are secure and maintained. That may not have been the case for many of them months ago, before "No Trespassing" signs suddenly appeared.

Two of the lots included a notice that they were among 18 to be auctioned off on June 30, 2010 at the Washington Convention Center - 501 Rhode Island Avenue in Shaw and the prime real estate Logan Circle property at 1335 R Street NW (The Victorian next door to the Logan Circle property sold for over $1.1 million in 2000). According to

Housing Complex, the 13th and R Street lot went for $590,000 after a bidding war.

According to a

press release, this was the second such auction of government-owned vacant property by the Property Acquisition and Disposition Division [results of the 1st

posted here]. Only bidders in specific categories were allowed to participate in the auction: home buyers who intend to occupy the property as their primary residence; non-profits; and DC Certified Business Entities. The Department of Housing and Community Development will hold a public hearing in August to announce the proposed disposition plans for the auctioned properties. That may be progress.

Another two of the properties, both in Columbia Heights, had already been sold and developed into condominiums - 2809 Sherman Avenue and 3004 13th Street NW. Also good. The house on Sherman appears to have been purchased in March 2009 (sale price not listed) and then sold as two units for $395,000 and $459,750 last summer. The 13th Street property was

auctioned off for $380,000 in January 2009 and then sold as two units this past March, with each fetching over $550,000. Wow.

There were some bad cases. In Ledroit Park, a historic corner property at 475 Florida Avenue NW has a skylight that is not of its own making. Curious that it sits in this condition, since it was apparently

auctioned off by DC in the first batch of vacant properties for $300,000 in January 2009 - did the sale fall through?

At 756 Park Road NW, a nice block that includes a police station also has a boarded up Home Again property - it's also on

the list as sold in January 2009 (for $160,000). Huh?

It's only a matter of time before what is left of 454 N Street NW collapses like its neighbor at 460 Ridge Street NW. At 1319 Harvard Street NW, neighbors appear to have taken charge by hiding an enclosed empty lot with a beautiful flower garden. Good for them!

The ugly, however, is 709 Kenyon Street NW. Posted prominently on the front of the house is a notice by the fire chief condemning the property as unsafe. The rear of the house, along with the roof, has partially collapsed. The alley alongside the property was filled with trash and empty beer cans and bottles.

Ward 1

475 Florida Avenue NW (Ledroit Park)

1319 Harvard Street NW (Columbia Heights)

756 Park Road NW (Columbia Heights)

709 Kenyon Street NW (Columbia Heights)

2809 Sherman Street NW (Columbia Heights)

3004 13th Street NW (Columbia Heights)

Ward 2

454 N Street NW (Mount Vernon Square)

460 Ridge Street NW (Mount Vernon Square)

501 Rhode Island Avenue NW (Shaw)

1818 6th Street NW (Shaw)

1735-1737 10th Street NW (Shaw)

1335 R Street NW (Logan Circle)

There’s the crumbling façade of a historic house on N Street that, aside from a chain link fence securing it, has remained frozen in time while all of the adjacent properties were renovated, rented, or sold. A rowhouse on Ridge Street collapsed in the middle of the night in 2007, leaving an empty lot. Two blocks away, the 1970s-era “porto-library,” resembling a highway rest stop, stands boarded up on New York Avenue since it closed 2 years ago.

There’s the crumbling façade of a historic house on N Street that, aside from a chain link fence securing it, has remained frozen in time while all of the adjacent properties were renovated, rented, or sold. A rowhouse on Ridge Street collapsed in the middle of the night in 2007, leaving an empty lot. Two blocks away, the 1970s-era “porto-library,” resembling a highway rest stop, stands boarded up on New York Avenue since it closed 2 years ago.  These 3 properties are in my neighborhood, but there are well over 100 city-owned vacant houses and lots across the city. Many remain in the same condition, and under city control, for a decade or more.

These 3 properties are in my neighborhood, but there are well over 100 city-owned vacant houses and lots across the city. Many remain in the same condition, and under city control, for a decade or more.  That does not count the larger properties, such as closed schools. Some have promises of future renovation. Others are slated for uses that are not in tune with the District’s comprehensive plan or surrounding community’s wishes. Downtown, the shuttered Franklin School, a historic gem built to teach 400 children as a model educational institution, is slated to become a 30-room boutique hotel.

That does not count the larger properties, such as closed schools. Some have promises of future renovation. Others are slated for uses that are not in tune with the District’s comprehensive plan or surrounding community’s wishes. Downtown, the shuttered Franklin School, a historic gem built to teach 400 children as a model educational institution, is slated to become a 30-room boutique hotel.